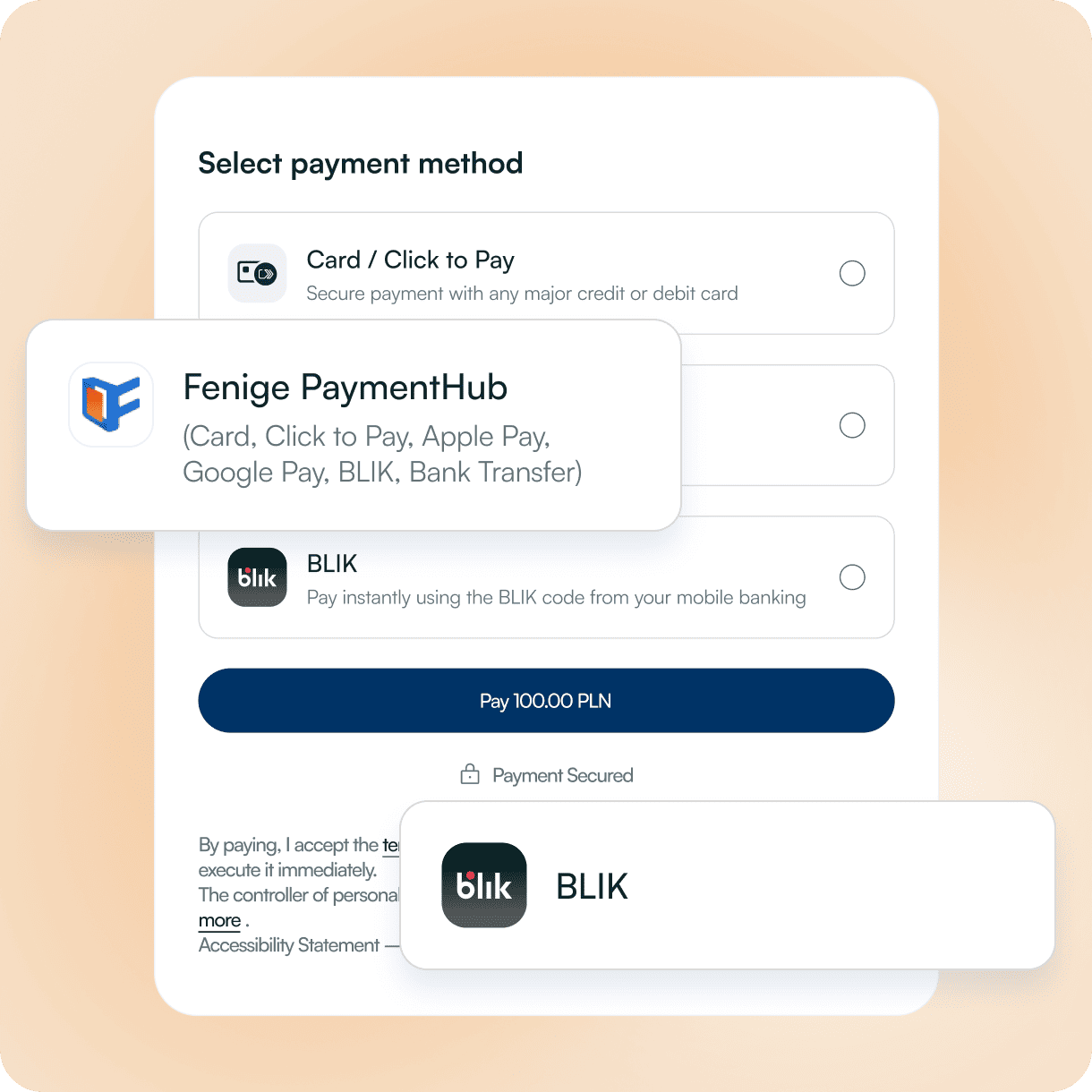

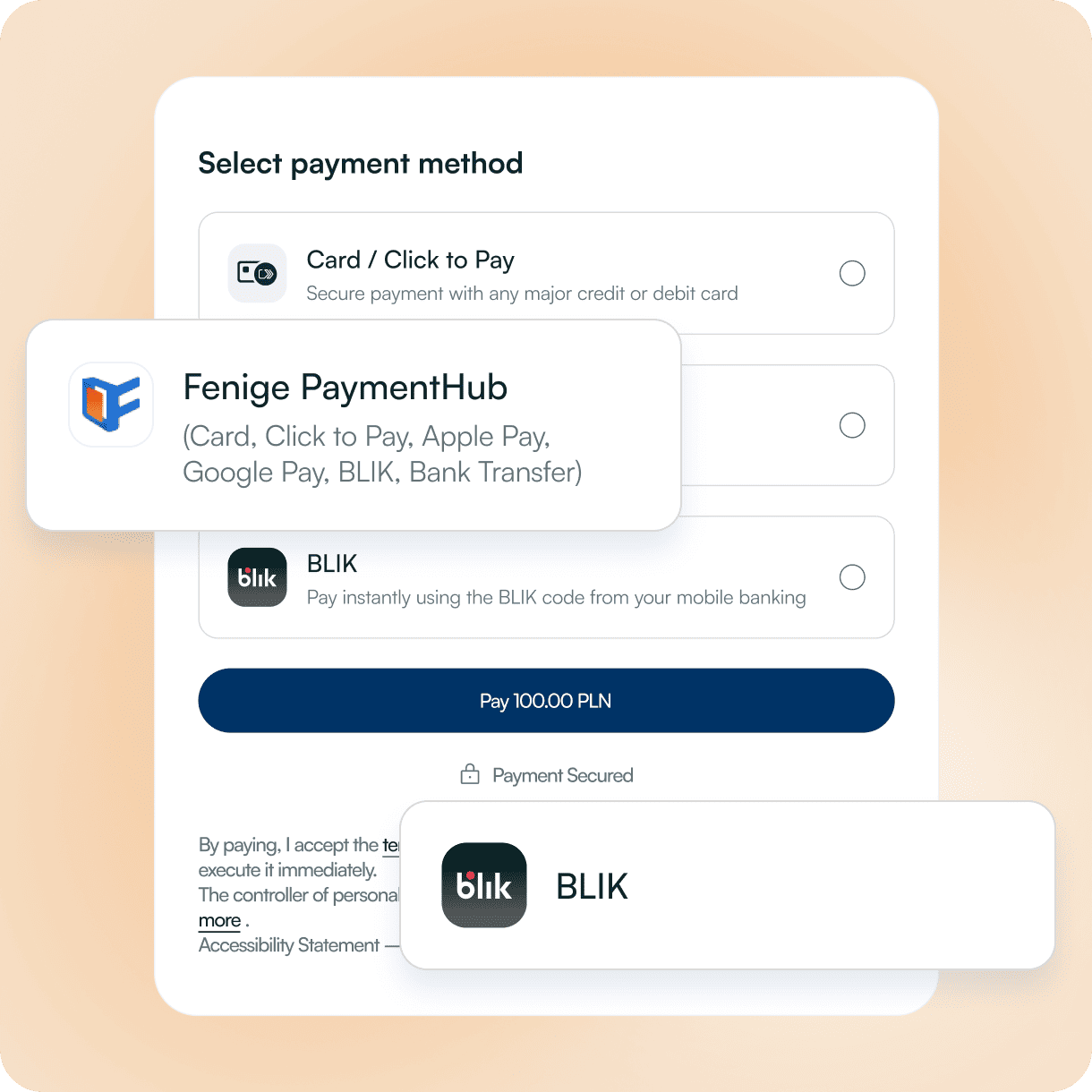

PaymentHub

Orchestrate all your online payments from one place – cards, open banking, BLIK, and wallets.

Let’s Talk

What is PaymentHub for e-commerce?

In simple terms: one hub, many payment flows.

Rather than running card acquiring, open-banking payments, BLIK, and wallets on isolated rails, PaymentHub:

White-label

is a white-label payment page which perfectly embeds into any website or mobile app with your logo and personalized background.

Different payment formats

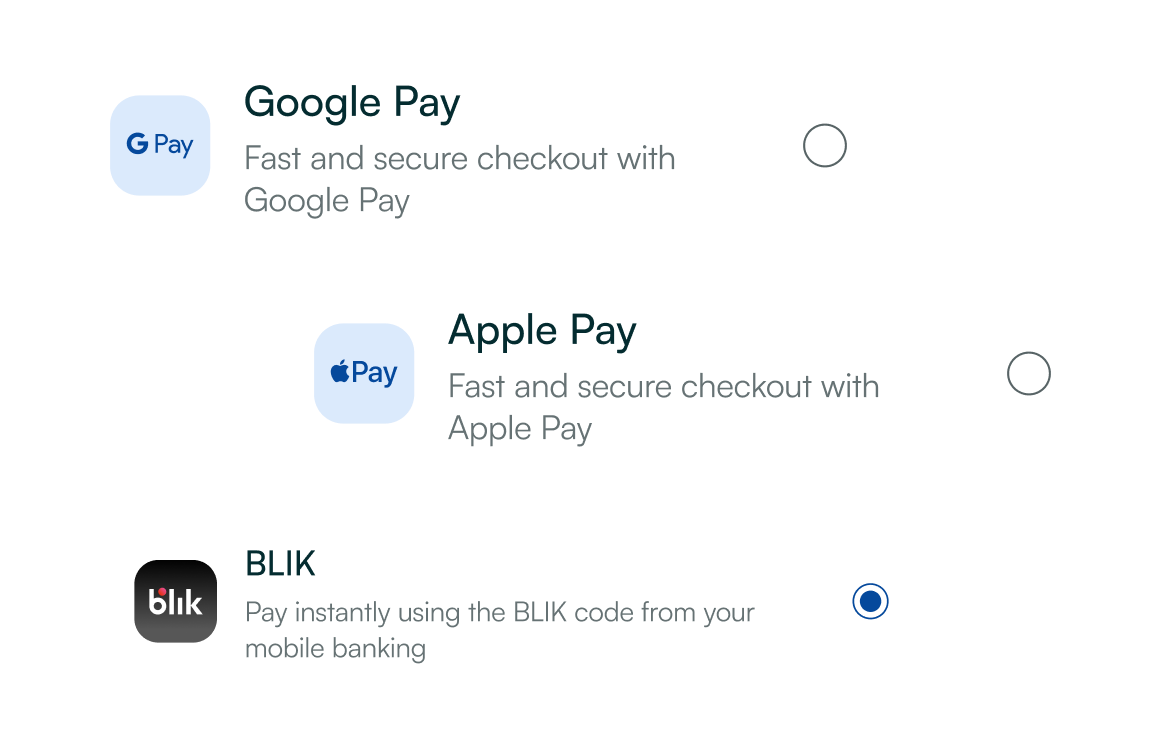

Consolidates different payment formats – card (Visa, Mastercard), open banking, BLIK, Apple Pay, Google Pay.

Direct integration

Integrates directly with payment rails and gateways

Intuitive interface

Exposes this as a single, intuitive interface and API for your team.

From an e-commerce perspective, PaymentHub becomes the “brain” behind your checkout flow: it standardizes how payments are initiated, monitored, reported and optimized across channels and markets.

Who is it for?

Online Merchants & Platforms

Growing online merchants & platforms that need more than a single basic gateway.

Aggregators & marketplaces

PSPs, aggregators and marketplaces looking to manage multiple merchants, payment methods and countries in a consistent way.

Fintechs and wallets

Fintechs and wallets that want to plug into cards, local methods and open banking through one hub instead of a patchwork of integrations.

E-commerce start-ups

E-commerce start-ups with limited IT capabilities, who want to benefit of an extensive, flexible, reliable, safe, ready-to-use payment page to finalize consumers’ payments.

Key benefits for e-commerce teams

One hub for many methods

Card payments, open banking, BLIK, Apple Pay, Google Pay are all supported inside the same PaymentHub solution. You configure methods per merchant or use case instead of maintaining separate systems.

Works with your existing gateway

Fenige’s PaymentHub is described as an integrated solution that can layer onto almost any gateway, adding better settlement, analytics and cross-border capabilities without forcing you to rip out everything you already have.

Unified reporting and reconciliation

Because payments from different channels land in one hub, you get a single view of transactions, which simplifies cash management, reconciliation and financial reporting for finance teams.

Security & compliance built in

PaymentHub runs on Fenige’s PCI-DSS-compliant infrastructure, with scheme-level security and EU payment-institution supervision in the background. That helps you keep sensitive data out of your own systems while still offering modern methods.

Ready for global growth

The hub is designed to support cross-border payments and multiple payment formats, which is exactly what you need when you add new markets, currencies or local methods.

How PaymentHub fits into your stack

Integrate once (API or via your gateway)

Your developers connect to PaymentHub via a dedicated API (documented in the Developer Zone) or through an existing gateway setup that Fenige can layer onto.

.png)

Enable the methods

you need

Together with Fenige, you decide which payment formats to turn on: cards, open banking, BLIK, Apple Pay, Google Pay, etc. This can be tailored per merchant, brand or country.

Route, monitor and optimize from one hub

PaymentHub centralizes transaction routing, monitoring, settlement and reporting, giving your ops, finance and product teams a single place to see what’s happening and adjust as you grow.

Want a single hub to run cards, BLIK, open banking and wallets for your e-commerce business?

Let’s Talk